GateUser-af80703f

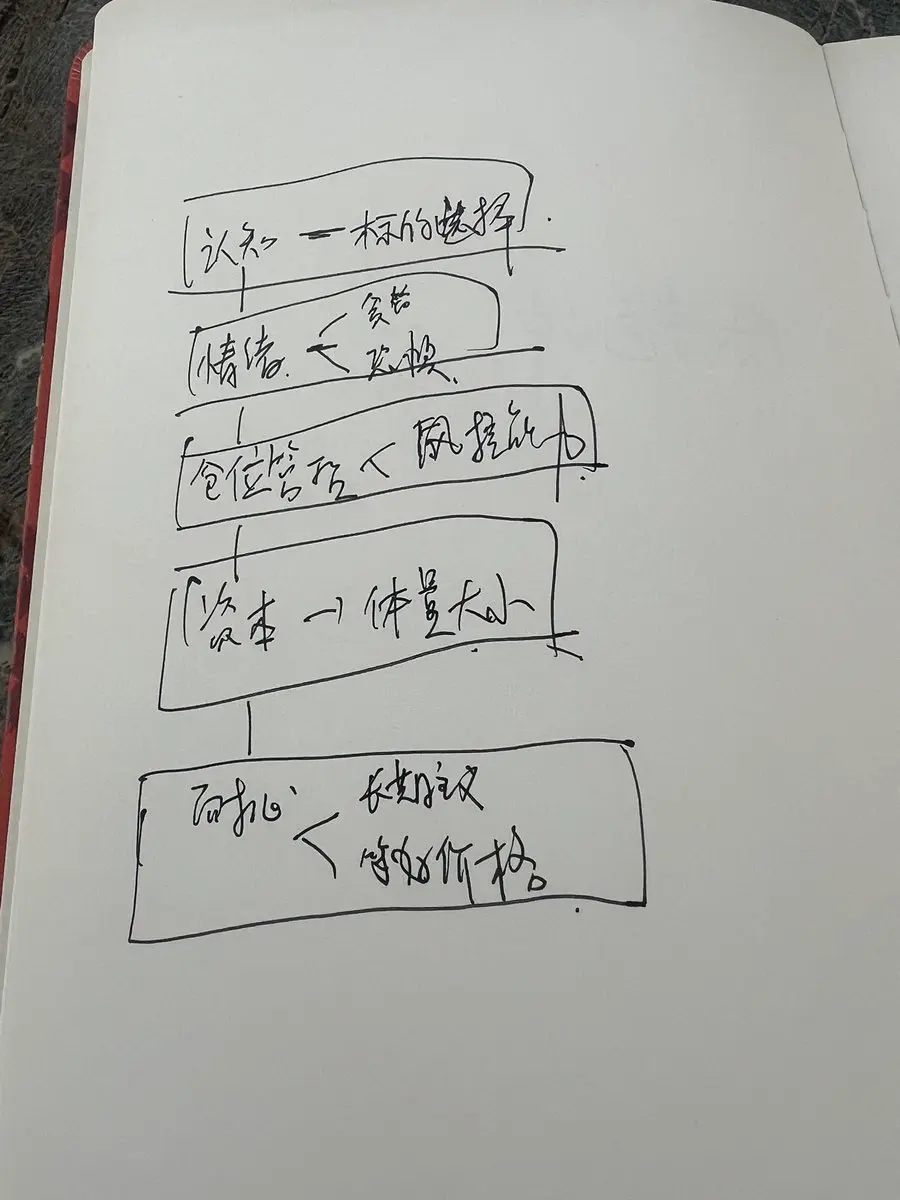

Go to a field that rewards your abilities, work hard, and shine.

Instead of going to a place that does not reward your abilities, trying to prove yourself and compete.

A tragicomedy of running to the wrong set, just like asking the Black Whirlwind Li Kui to write poetry, isn’t this just purely messing with people's mindset?

View OriginalInstead of going to a place that does not reward your abilities, trying to prove yourself and compete.

A tragicomedy of running to the wrong set, just like asking the Black Whirlwind Li Kui to write poetry, isn’t this just purely messing with people's mindset?